Within the last year, several logistics and retail companies, researchers, and startups announced their interest in using blockchain technology for last-mile delivery solutions:

- Walmart implements blockchain-based delivery system

- Blockchain Technology: Possibilities for the U.S. Postal Service

- Carrefour implements blockchain as part of supply chain transformation

This article gives a summary of current challenges, initiatives and the possible future of the industry that will be opened by using blockchain technology.

Industry perspective: IoT penetration driven by eCommerce growth

Industrial globalization and ecommerce growth is leading to new challenges for retail and logistics companies. According to recent Accenture research, customer expectations are based on three main issues right now:

- Delivery control: consumers are demanding a better last mile service that keeps them in control of how, when and where their parcels are delivered.

- Delivery locations: as choices broaden, consumers want new delivery options such as lockers or pickup locations that enable a secure, 24×7 and sometimes anonymous delivery option.

- Delivery timing: there is significant investment in speed; logistics companies should focus on giving consumers a range of delivery times (often at different price points) to provide flexibility.

All these challenges will lead to the automatization of last-mile delivery. According to McKinsey research, the level of automated last-mile solution penetration will reach 90% within ten years by drones, automated parcel lockers or, eventually, by automated guided vehicles (AVGs) with parcel lockers. If we think about all these devices as IoT devices, we should consider current limitations of this market as serious constraints for further market growth.

First of all, the pervasiveness of such devices in our society will require more confidence in security across the entire ecosystem. For example, in 2014 the first cyber IoT attack was carried out and confirmed when 750,000 consumer devices were compromised via phishing and spam emails. So, in the potentially huge market of last-mile IoT devices that interact with consumers on a regular basis, ensuring the security of the data, systems and devices, as well as the privacy of the data and data computations, is crucial as the impact of possible cyber attack on centralized IoT systems will be more powerful.

The second challenge is scalability of these devices. To manage these systems we need an ever growing capacity and bandwidth in the cloud. It is not realistic to expect the IT team to be familiar with every individual connected device, although they have the system administrator capability to install patches, access the device and their data remotely, and so on. So in addition to less confidence in security across the entire ecosystem, with centralized device management, we will receive very high cost of installation and maintenance.

The third limitation is the increasingly complex interoperability between companies. This helps to create the monopolization of industry verticals by big players that want to meet customers’ expectations, such as Amazon who this year started launching end customer delivery that essentially makes them the owner of the whole ecosystem chain. Larger market players create standardization in the technology stack to integrate across technology vendors, standard protocols for sharing between systems, standard access to external data sources etc. So it is almost impossible for small and medium players to compete against these players without cooperation with them.

That leads us to the last but not least problem of development for this industry; security, privacy, and confidentiality of customers’ data that are gathered by all these devices.

That’s a limited list of reasons why the IoT industry needs to be rebooted to give the push for last-mile devices delivery.

Blockchain as the solution for revolutionize last-mile delivery challenges

Although there are a lot of different approaches for the scaling of IoT solutions, especially on a security level, blockchain technology is a very elegant way to revolutionize the industry and make the internet of things of the last-mile delivery industry a truly scalable and autonomous solution.

To understand how exactly. here is a brief explanation of Blockchain and IoT infrastructure elements.

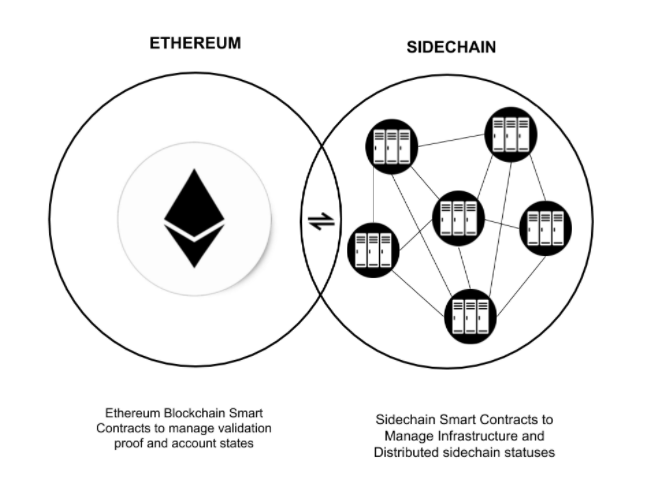

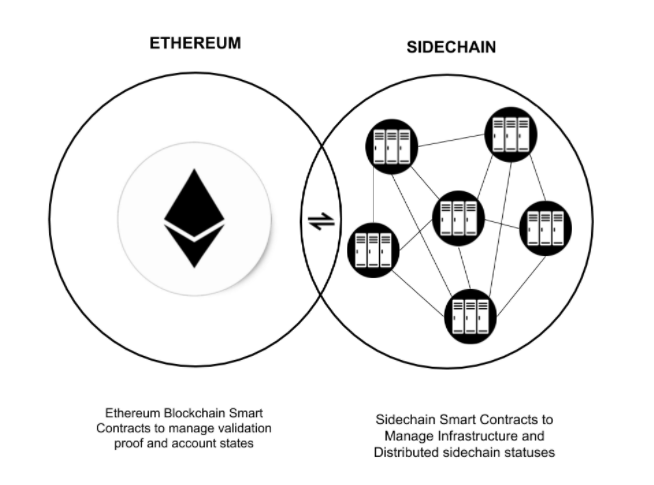

- IoT hardware interacts with the physical world, perceives the physical information, converts it to digital information and stores it on the ledger as a causal chain.

- Blockchain represents the physical world and maintains one or many causal chains in the form of blockchain. Sidechain can be used to speed up transactions, reduce costs, and diminish computational load.

- Smart contracts provide a character to the “things”, for example an independent agenda for each station (goal, plans, policy and context) and update the ledger state through consensus. In other words, agent causation in the physical world is preceded by causation on the ledger, which in turn is preceded by consensus-based deliberation.

So, blockchain technology provides a very elegant and relatively easy solution to solve challenges of increasing number of devices in last-mile delivery industry. Picture 1 describes one possible configuration of blockchain interaction.

Picture 1. Example of Last-mile IOT Sidechain on Ethereum.

Security. Decentralization of the system will allow mitigation of the risk of network failure because the integrity of the system is no longer reliant on penetrating single nodes. Instead it will rely on consensus between the nodes.

Scaling. By distributing computational and storage needs across devices in the network, instead of relying on central servers, the decentralized system will allow scaling and managing last-mile devices more easily.

Interoperability. Open protocols will allow establishment of trust with consumers for sharing data. Additionally, retail and logistics companies can eventually establish collaboration across companies and industry verticals to achieve horizontal data aggregation without putting in jeopardy security, privacy, and confidentiality issues.

The post Blockchain technology beyond cryptocurrencies: the future of last-mile delivery autonomous solutions appeared first on UC Berkeley Sutardja Center.