Berkeley Blockchain Lab featured in Wired

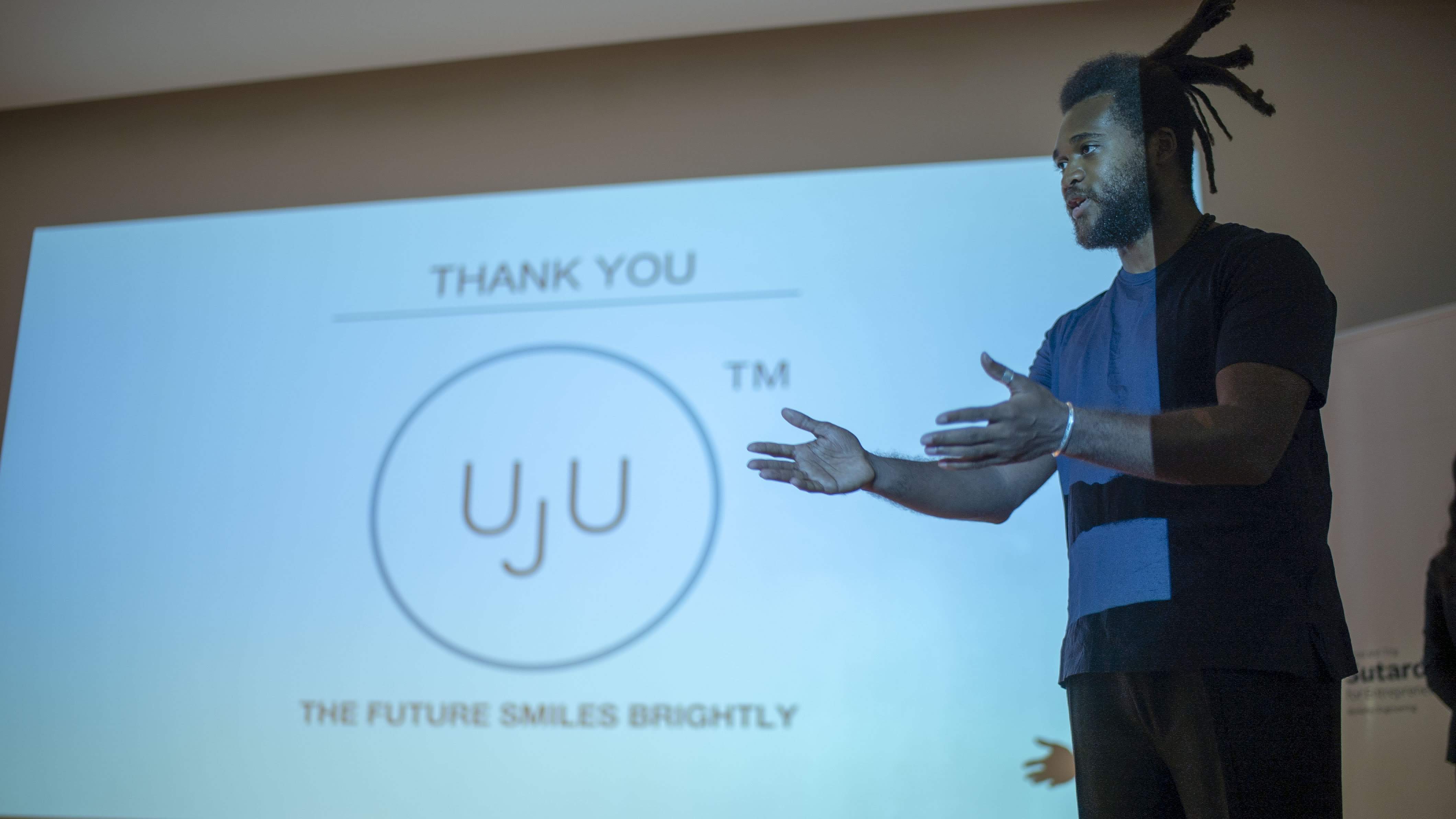

The University of California, Berkeley’s Sutardja Center for Entrepreneurship & Technology (SCET) is one of the first institutions to offer university courses on blockchain technology. Specifically, SCET’s Blockchain Lab facilitates collaboration between new ventures, industry scholars, and academics to evaluate, validate, and execute innovative blockchain projects. “Academics feel a lot Read more…